Context :- The Sixteenth Finance Commission, chaired by economist Arvind Panagariya, has submitted its report to the President of India, The Sixteenth Finance Commission’s recommendations would apply for a period of five years beginning on April 1, 2026.

The 16th Finance Commission: Framework, Mandate, and Challenges:

Constitutional Architecture

- Authority: Constituted by the President of India under Article 280 of the Constitution.

- Frequency: Established every five years or earlier.

- Primary Objective: To ensure Fiscal Federalism by preventing vertical (Centre-State) and horizontal (Inter-State) fiscal imbalances.

- Composition: Consists of a Chairman and four other members.

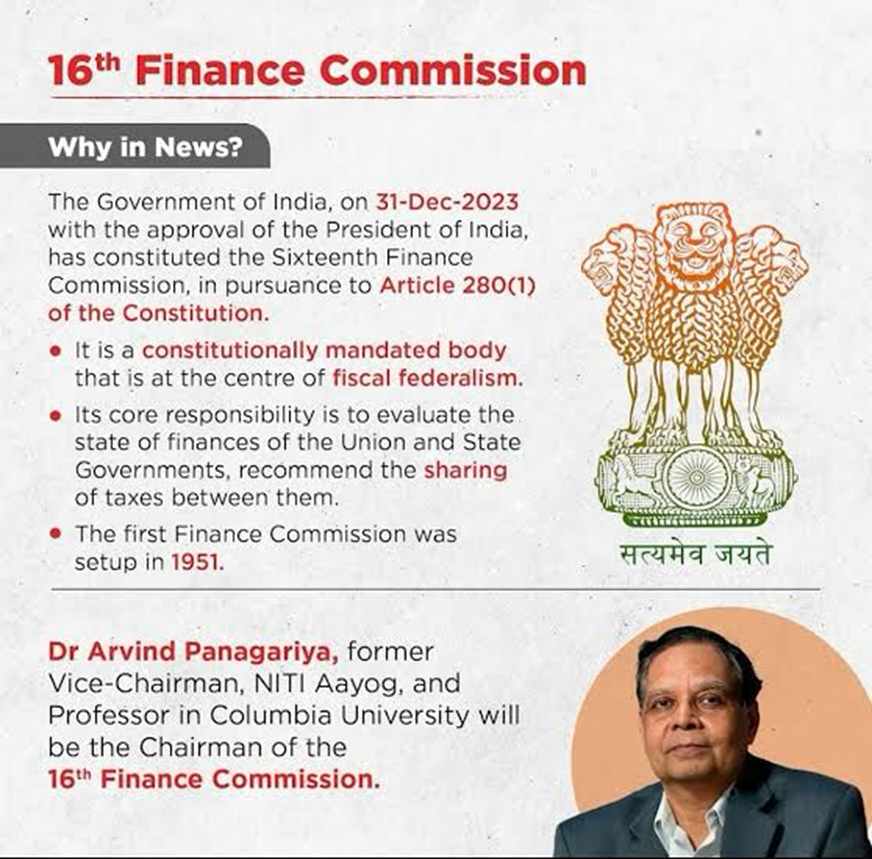

- The 16th Finance Commission

- Chairman: Dr. Arvind Panagariya.

- Operational Period: Recommendations will cover the five-year period commencing April 1, 2026.

Terms of Reference :

- The Commission is mandated to make recommendations on the following:

- Vertical Devolution: Distribution of net tax proceeds between the Union and the States.

- Grants-in-Aid: Principles governing grants-in-aid of revenues to States out of the Consolidated Fund of India.

- Local Governance: Measures to augment the Consolidated Fund of a State to supplement resources of Panchayats and Municipalities.

- Disaster Financing: Reviewing the current financing arrangements for Disaster Management initiatives under the Disaster Management Act, 2005.

Critical Challenges & Focus Areas

- Protecting Devolution Share: Maintaining the 41% devolution pool for states amidst rising central cesses and surcharges (which are not shared with states).

- Bridging Regional Disparities: Designing a formula that supports less developed regions without disincentivizing performing states.

- Urban Financing: Addressing the ₹840 billion infrastructure funding gap caused by rapid urbanization.

- Rationalizing CSS: Reforming Centrally Sponsored Schemes to grant states greater fiscal autonomy and flexibility.

- Fiscal Prudence vs. Welfare: Balancing the need for welfare expenditures (addressing the “Freebie Culture”) with long-term debt sustainability and fiscal health.

- Post-COVID Recovery: Accounting for the structural shifts in healthcare costs and revenue losses triggered by the pandemic.