Why in the News?

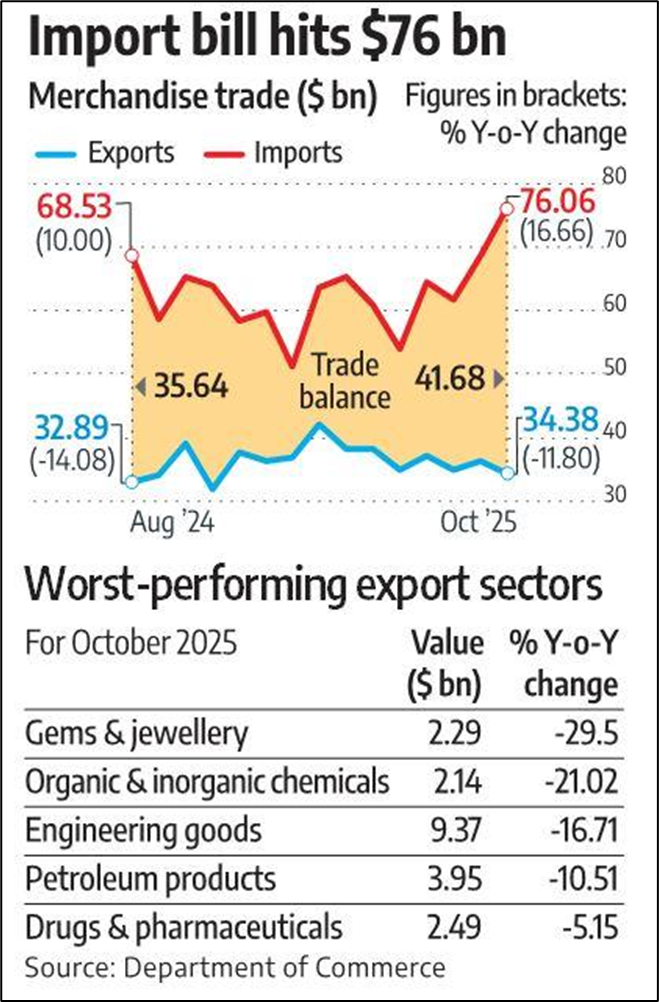

The trade deficit surged to an unprecedented $41.68 billion in October 2025, exceeding analyst forecasts of around $30 billion. This record deficit is attributed to two major forces:

- Surge in Imports (16.6% Year-on-Year rise): Imports rose sharply to $76.06 billion, primarily driven by a massive, non-essential inflow of Gold and Silver (Gold imports jumped to $14.72 billion in October from $4.92 billion a year earlier) due to the festive season (Diwali, Dussehra) and a cut in consumption tax.

- Sharp Contraction in Exports (11.8% Year-on-Year fall): Exports plummeted to $34.38 billion. This decline is largely linked to the punitive 50% tariff imposed by the US on Indian goods in late August 2025, coupled with a general global economic slowdown and high base effect from the previous year.

- Rupee Pressure: The record deficit places further pressure on the Indian Rupee (INR), which has already been one of Asia’s worst-performing currencies, hovering near its record low of ₹88.8050 to a dollar.

Key Analysis: External Shocks vs. Structural Faultlines

The trade deficit is not purely a result of temporary factors; it exposes the structural fragility of India’s manufacturing and export sectors in the face of external headwinds.

1. The Shock of US Tariffs and Export Vulnerability

The US, being India’s largest trading partner, imposed tariffs of up to 50% on a wide range of Indian goods, including a 25% penalty for Russian oil purchases.

- Impact on Key Sectors: The tariffs have severely hit labor-intensive sectors that are crucial for employment, such as Textiles and Apparel (exports fell 12.9%), Gems and Jewellery (fell 29.5%), Engineering Goods (fell 16.7%), and Marine Products (Seafood).

- Analysis: This underscores the lack of sufficient export diversification and high reliance on single markets (US) for several major goods categories.

- Competitiveness Erosion: The 50% duty makes Indian goods uncompetitive relative to Asian rivals like Vietnam and Bangladesh, which face significantly lower tariffs in the US market.

- Market Diversification (Silver Lining): Despite the overall fall, some reports suggest Indian exporters are showing resilience by successfully redirecting exports to markets like China, Spain, and Sri Lanka, and pursuing new market approvals (e.g., Australian approval for Indian shrimp).

2. The Import Structure and Domestic Demand

While the gold import surge is temporary, the underlying import structure reveals dependency issues.

- Non-Essential Imports: The $14.72 billion gold import figure, driven by festival demand and tax cuts, is a temporary, policy-induced spike. While this is not a sign of economic health, it indicates robust domestic consumer demand after a cut in consumption tax.

- Capital and Essential Imports: Imports of machinery and project goods also showed significant increases (12.2% and 45.5% respectively). While contributing to the deficit, this is indicative of strong domestic investment and infrastructure activity—a positive signal for future economic growth.

- Oil Imports: Crude petroleum imports declined due to lower global prices, preventing the deficit from widening even further.

Economic and Financial Implications

The record trade deficit has wide-ranging consequences for India’s macroeconomic stability.

1. Currency and Inflation Risk

- Rupee Depreciation: A higher trade deficit increases the demand for the US Dollar (USD) relative to the Rupee (INR). This puts downward pressure on the Rupee, increasing the risk of further depreciation from the current level near ₹88.80.

- Inflationary Pressure: A weaker Rupee makes imports more expensive (especially crude oil, electronics, and machinery). Since India is highly import-dependent for energy and manufacturing inputs, this depreciation fuels imported inflation, making it harder for the RBI to manage headline inflation.

2. Balance of Payments (BoP) and Foreign Reserves

- Current Account Deficit (CAD): The trade deficit is the largest component of the CAD. A massive trade gap suggests the CAD for the fiscal year could be significantly higher than expected.

- Services Sector Cushion: The merchandise trade gap is partially offset by a large Services Trade Surplus (nearly $20 billion in October 2025). This surplus, primarily driven by IT and IT-enabled services, acts as a crucial cushion for India’s BoP position.

Challenges Exposed by the Deficit

- Vulnerability to Geopolitics: The swift imposition of high tariffs by the US exposed India’s reliance on a single major market and its vulnerability to geopolitical trade disputes.

- MSME Sector Distress: The hardest hit sectors (Textiles, Gems) are dominated by Micro, Small, and Medium Enterprises (MSMEs). These enterprises lack the financial capacity to absorb a 50% tariff hike or quickly reorient their supply chains.

- Lack of Manufacturing Depth: Despite initiatives like ‘Make in India,’ the continued high import of machinery, electronics, and industrial inputs shows that India’s domestic manufacturing base lacks the depth to substitute these essential imports.

Way Forward: Reinforcing the External Sector

- Market and Product Diversification:

- Action: Aggressively pursue Free Trade Agreements (FTAs) with non-US markets (EU, UK, Australia, GCC) to create alternative export channels and reduce reliance on a single market.

- Example: Provide targeted incentives and logistical support (subsidies, quick clearances) to exporters redirecting shipments to newly established partner countries.

- Strategic Support to MSMEs and Affected Sectors:

- Action: Swiftly implement the recently approved Export Promotion Mission (EPM) with an outlay of ₹25,060 crore over six years.

- Example: Ensure the promised relief measures, including interest subsidies and liquidity support, quickly reach affected labor-intensive sectors (Textiles, Engineering) to maintain their competitiveness against rivals like Vietnam and Bangladesh.

- Fiscal Prudence and Import Rationalization:

- Action: Adopt a cautious approach to fiscal policy to avoid overheating demand that exacerbates imports. Review and rationalize non-essential imports like Gold and Silver through calibrated duty hikes or other non-tariff barriers to manage the deficit without hurting essential capital goods imports.

- Exchange Rate Management:

- Action: The RBI must continue its managed float strategy to prevent excessive volatility.

- Example: Utilize India’s strong Forex Reserves (over $700 billion as of September 2024) to stabilize the Rupee, but also allow gradual depreciation to act as a long-term automatic stabilizer by making exports cheaper and imports costlier.

Source: Excessive dependence: On India’s external trade landscape – The Hindu

UPSC CSE PYQ

| Year | Question |

| 2023 | Examine the developments of Industrial Corridor projects in India. Assessing the impact on India’s external trade and foreign investment. |

| 2022 | Examine the long-term implications of India’s policy of competitive exclusion and free trade agreements on its economy. |

| 2020 | Why is the Public-Private Partnership (PPP) model required for infrastructure projects? Examine the role of PPP model in the light of the present financial scenario in India. |

| 2019 | Do you agree that the Indian economy has recently experienced V-shaped recovery? Give reasons in support of your answer. |

| 2018 | What are the main bottlenecks in the up-gradation of Indian industry? Can ‘Make in India’ and other such schemes help to push India’s industrial base? |

| 2017 | Account for the failure of manufacturing sector in achieving the target of labour-intensive exports. Suggest measures for its course correction. |

| 2020 | What is meant by minimum wage? How can minimum wage lead to reduction in poverty? |