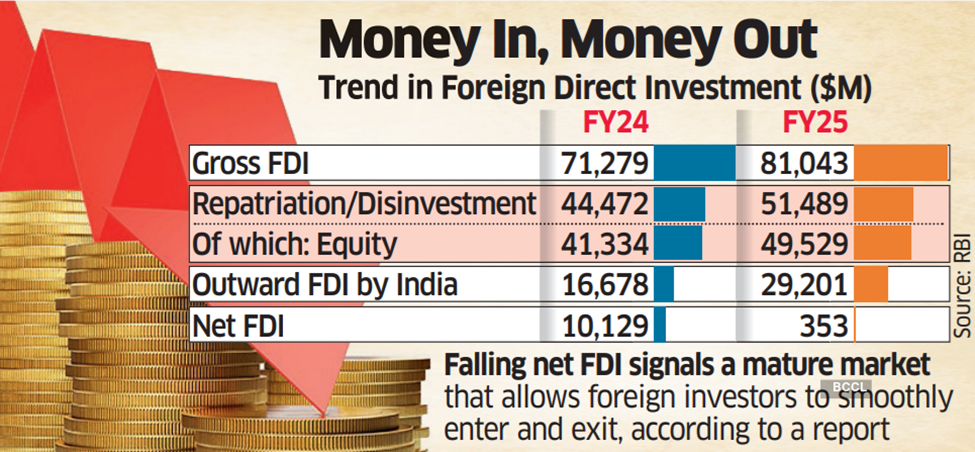

Context: For the second consecutive month (September 2025), India recorded a Negative Net Foreign Direct Investment (FDI).

Conceptual Framework and Regulation

- Definition: FDI refers to investment through equity instruments by a non-resident entity in an unlisted Indian company, or 10% or more of the paid-up equity capital in a listed Indian company.

- Regulatory Architecture: Governed by the Consolidated FDI Policy (2020) and FEMA (Non-Debt Instruments) Rules, 2019.

Gross vs. Net FDI:

- Gross FDI: Total direct investment inflows into productive assets.

- Net FDI: Gross Inflows minus Outflows (Repatriation of profits + Outward Direct Investment by Indian firms).

Investment Routes and Prohibitions

- Automatic Route: No prior approval required from the RBI or Government. Currently, 90% of FDI enters via this route.

- Permitted Sectors: Agriculture, Telecom, Oil & Gas, Airports (Greenfield), Industrial Parks, etc.

- Government Route: Mandatory prior approval required to ensure compliance with specific conditions.

- Prohibited Sectors: Lottery, Gambling/Betting (including casinos), Chit Funds, Nidhi Companies, and sectors closed to private players (e.g., Atomic Energy, Railway Operations).

Strategic Significance of FDI

- Non-Debt Capital: Serves as a sustainable, long-term financial resource that facilitates technology transfer and strategic development.

- Economic Stability: Bolsters forex reserves; as of May 2025, reserves cover 11+ months of imports and 96% of external debt (RBI Bulletin).

- Greenfield Growth: Capital expenditure in greenfield projects is projected to rise by ~25% to USD 110 billion in 2024 (UNCTAD WIR 2025).

- Sustainable Finance: India leads as the largest issuer of carbon credits in the Verra Registry.

Analysis: Reasons for Declining Net FDI

- Despite robust gross inflows, Net FDI has faced downward pressure due to:

- Surge in Outward Investment (ODI): Indian entities are investing globally, aided by liberalized Overseas Direct Investment (ODI) guidelines (2022). FY25 saw Indian ODI rise to $12.5 billion.

- Increased Repatriation: Higher profit-booking and exit by foreign investors indicate a maturing market cycle.

Global Headwinds:

- Geopolitical Tension: Rising trade tariffs (specifically by the USA) and weak global demand.

- Global Decline: Worldwide FDI contracted by 11% (YoY) in 2024.

Government Interventions and Reforms

- Sectoral Liberalization: Increased FDI caps in strategic sectors (e.g., Union Budget 2025 raised Insurance sector FDI to 100%).

- Regulatory Ease: The Jan Vishwas Act, 2023 decriminalized 183 provisions to improve the business climate.

- Institutional Support: Establishment of Project Development Cells (PDCs) and promotion of Competitive Federalism via BRAP and LEADS rankings.

- Strategic Agreements: Signing of Bilateral Investment Treaties (UAE, Uzbekistan) and TEPA with EFTA.

Way Forward :

- Policy Stability: Emulate models like Vietnam’s 10-year economic plans to offer regulatory predictability.

- Digital Economy: Leverage the 14% global rise in digital economy investments by shaping coherent multilateral rules.

- Fiscal Incentives: Utilize targeted tax breaks and subsidies to steer capital into high-priority sectors.

- International Reform: Advocate for a reformed international financial system to manage global investment risks and hybrid capital lending.