- The Union Government has introduced two significant legislations in Parliament:

- The Central Excise (Amendment) Bill, 2025

- The Health Security se National Security Cess Bill, 2025

- Primary Objective: To maintain the tax incidence on tobacco products and pan masala as the GST Compensation Cess is set to be discontinued shortly.

2. Background: The GST Compensation Cess

- Origin: Introduced in 2017 during the rollout of the Goods and Services Tax (GST).

- Purpose: To compensate States for revenue losses arising from the transition to GST for a period of five years.

- Extension: The levy was extended beyond five years to repay loans borrowed by the Centre to compensate States during the COVID-19 revenue shortfall (2020-22).

- Current Status: The cess is being discontinued as the loan repayment is nearing completion.

3. Decoding the New Legislations

A. Central Excise (Amendment) Bill, 2025

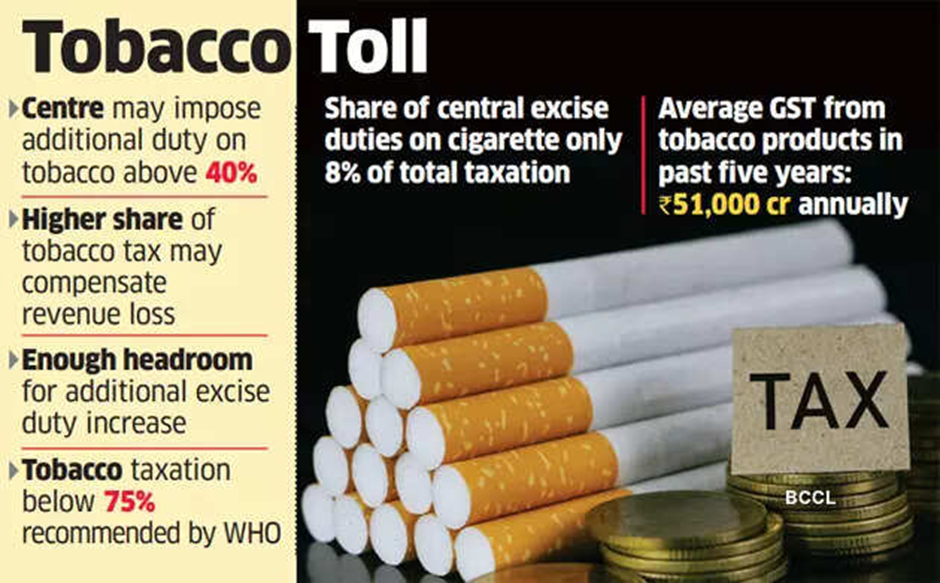

- Rationale: Once the GST Compensation Cess is removed, the effective tax rate on tobacco would drop, leading to revenue loss and potentially higher consumption (health risk).

- Mechanism: The Bill creates fiscal space to increase the Basic Central Excise Duty on tobacco products.

- Outcome: It ensures the total tax burden (Tax Incidence) remains the same even after the cess is removed.

B. Health Security se National Security Cess Bill, 2025

- Target Commodity: Primarily targets Pan Masala manufacturing (and other notified goods).

- Usage of Funds: Proceeds will be earmarked for Public Health and National Security expenditure.

- Key Feature: Capacity-Based Taxation

- Instead of taxing the actual quantity produced, the cess is levied based on the production capacity of machines installed in the factory.

- Self-Declaration: Manufacturers must declare their machinery; the cess is calculated on the aggregate capacity.

- Logic: This method curbs tax evasion in sectors prone to under-reporting production (like pan masala and gutkha).

Static Linkages:

| Concept | Explanation |

| Cess vs. Tax | A Tax goes into the Consolidated Fund of India (CFI) and can be used for any purpose. A Cess is a tax on tax, earmarked for a specific purpose (e.g., Education Cess, Health Cess). |

| Article 270 | Cess and Surcharges are NOT shareable with State Governments (unlike basic Income Tax or GST). The Centre retains 100% of the proceeds. |

| Excise Duty | An indirect tax levied on the manufacture/production of goods within the country. (Tobacco attracts both GST and Central Excise Duty). |