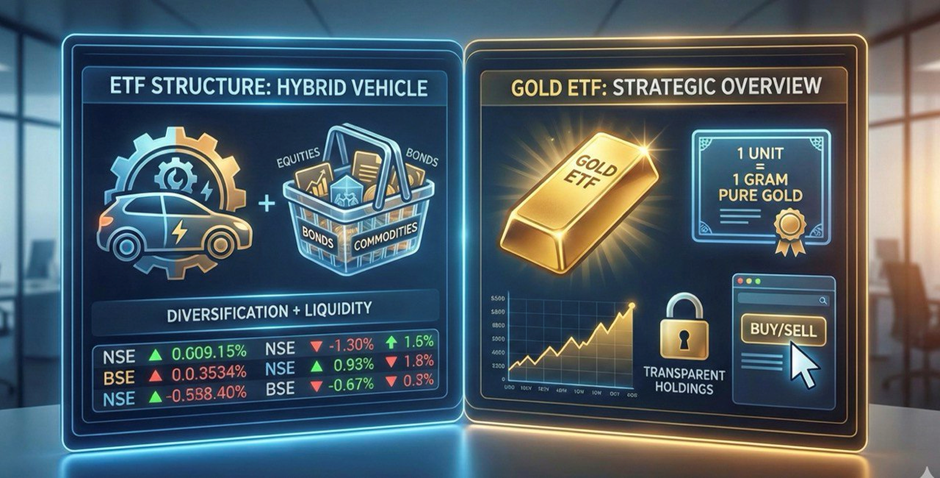

An Exchange Traded Fund (ETF) functions as a hybrid investment vehicle, combining the diversification of mutual funds with the trading flexibility of stocks.

- Basket of Securities: Represents a diverse collection of investments, including equities, bonds, or commodities.

- Market Liquidity: Trades directly on stock exchanges, functioning operationally like an individual stock.

- Cost Efficiency: Generally offers a more distinct cost advantage with lower expense ratios compared to other fund types or physical asset investments.

Gold ETFs :

Gold ETFs are specialized commodity-based instruments designed for investors seeking exposure to the gold market without the challenges of physical storage.

Core Characteristics

- Underlying Asset: These are passive investment instruments strictly backed by physical gold bullion.

- Unit Valuation: Each ETF unit corresponds to 1 gram of high-purity physical gold, held in paper or dematerialized form.

- Transparency: Offers high clarity regarding holdings due to direct correlation with real-time gold pricing.

Trading & Accessibility

- Exchange Listing: Fully listed and actively traded on major Indian exchanges: the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

- Liquidity: Provides immediate liquidity similar to equity trading, unlike traditional physical gold.