Why in the News?

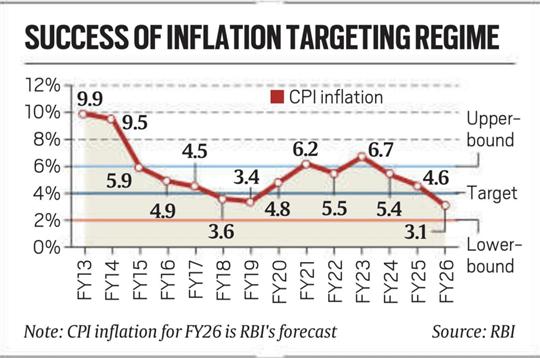

The Reserve Bank of India (RBI) has initiated a review of the Flexible Inflation Targeting (FIT) framework as the current mandate (4% CPI with a ±2% band) expires in March 2026.

A discussion paper has been released seeking views on:

- Whether the target should be headline inflation or core inflation.

- What inflation level should be considered acceptable.

- What the width and purpose of the tolerance band should be.

This review will shape monetary policy for the next several years and has major implications for growth, fiscal discipline, and macroeconomic stability.

Context / Background

- FIT was formally adopted in 2016 under the amended RBI Act.

- The target of 4% CPI was chosen based on the Urjit Patel Committee’s recommendation.

- India’s inflation dynamics are unique due to:

- High food weight in CPI (~46%).

- Frequent supply shocks (weather, logistics).

- Large informal sector affecting wage–price transmission.

- Prior to reforms (1970s–80s), monetisation of fiscal deficits contributed to persistent inflation.

The upcoming review is an opportunity to refine operational rules and resolve ambiguities that affect credibility and policy effectiveness.

Detailed Assessment

1. Target Choice: Headline vs Core Inflation

1.1 Headline Inflation as Target — Rationale

- Welfare Protection: Food has the largest weight in CPI; volatility impacts poor households disproportionately.

- Captures Overall Prices: Reflects the real cost of living for consumers and wage-setters.

- Expectation Anchoring: Food price shocks can spill over into wages and services; ignoring them weakens anchoring.

- Financial Stability: High headline inflation erodes savings, hurts pensioners, and increases nominal interest rates.

1.2 Concerns with Core Inflation as Target

- Excludes food and fuel — major items for Indian households.

- Underestimates welfare losses during food shocks.

- Can misguide policy in a food-dominant economy.

- Risk of appearing “indifferent” to actual inflation experienced by citizens.

1.3 Counter-Arguments (for core)

- Helps avoid overtightening during temporary supply shocks.

- May reduce output volatility.

But these benefits depend on stable expectations and effective communication — both still evolving.

1.4 Balanced Approach

- Keep headline as the formal target.

- Use core as an analytical indicator for trend assessment, not as the policy anchor.

2. Acceptable Level of Inflation

2.1 Evidence from Growth–Inflation Relationship

- Empirical studies show a non-linear relationship:

Growth begins to suffer significantly once inflation crosses ~4–6%. - Too low inflation reduces flexibility for real wage adjustments.

- Too high inflation erodes purchasing power, destroys savings, and disrupts investment planning.

2.2 Policy Signal

A central target near 4% provides a good balance between economic flexibility and macroeconomic stability.

3. Role and Width of the Inflation Band

3.1 Why a Band Exists

- Provides flexibility for supply shocks.

- Helps avoid excessive volatility in interest rates.

3.2 Challenges Noted

- Staying persistently near the upper band (6%) undermines credibility.

- Lack of clarity on:

- Duration of deviations permitted,

- Use of escape clauses,

- Accountability measures when targets are breached.

3.3 Needed Clarifications

- Define operational rules for band usage.

- Specify communication strategy during deviations.

- Strengthen accountability through timely performance reports.

4. Structural Features That Influence India’s FIT

4.1 High Food Weight in CPI

- Makes headline inflation highly sensitive to monsoon, MSP policies, and global commodity cycles.

4.2 Informal Labour Markets

- Wage adjustments are slower and more volatile, making expectation management harder.

4.3 Fiscal–Monetary Linkages

- Large deficits and unpredictable government borrowing reduce monetary policy effectiveness.

- Past monetisation episodes illustrate the inflationary risks of weak coordination.

5. Communication & Expectations Management

5.1 Importance of Clear Guidance

- Transparent policy reduces uncertainty.

- Anchored expectations improve growth–inflation trade-off.

5.2 What Needs Improvement

- Clearer communication on:

- Why inflation deviates,

- Expected correction timeline,

- Policy response path.

- Regular forward-looking assessments.

Challenges

- Persistent Food Volatility: Supply shocks can push inflation above target despite tight monetary policy.

- Fiscal Pressures: High government borrowing can crowd out private investment and affect inflation expectations.

- Credibility Risks: Repeated breaches or staying near the upper band weaken trust in the framework.

- Transmission Weakness: Credit markets in India still have rigidities; policy takes time to pass through.

- Communication Gaps: Ambiguity in press statements or sudden policy moves can unsettle markets.

Way Forward

1. Strengthen Supply-Side Interventions

- Improve food supply chains, cold storage, and logistics.

- Build resilient buffer stock mechanisms.

- Reduce volatility through better crop diversification and market reforms.

2. Enhance Fiscal–Monetary Coordination

- Adhere to medium-term fiscal consolidation paths.

- Provide predictable borrowing calendars.

- Avoid quasi-fiscal operations that blur responsibilities.

3. Clarify Operational Rules

- Define how long inflation can remain outside the band.

- Specify escape clauses and accountability timelines.

- Publish detailed performance evaluations.

4. Communication Reforms

- Provide clear, transparent forward guidance.

- Summaries of deliberations, analytical assessments, and expected inflation trajectory.

5. Maintain the 4% Target

- Retain headline CPI as the anchor.

- Use core inflation only for analytical support.

- Maintain ±2% band but improve guidance around deviations.

Conclusion

Flexible Inflation Targeting has stabilised India’s monetary policy framework and anchored inflation expectations effectively. Retaining a headline CPI target around 4% with a ±2% band remains appropriate given India’s structural characteristics. The next phase should focus on strengthening operational rules, improving communication, and enhancing fiscal–monetary coordination. With better supply-side management and clearer band-usage norms, the framework can deliver both price stability and sustained economic growth.

Source: Flexible inflation targeting, a good balance – The Hindu

UPSC CSE PYQ

| Year | Question |

| 2013 | Discuss the causes and consequences of persisting inflation in India. |

| 2014 | In the context of inflation control, explain how monetary policy instruments are used in India. |

| 2015 | The Reserve Bank of India has recently adopted inflation targeting as its primary objective of monetary policy. What are the advantages of inflation targeting? Critically examine its limitations in the Indian context. |

| 2015 | What are the major reasons for inflationary pressure in the Indian economy? Suggest measures to control it. |

| 2016 | The establishment of the Monetary Policy Committee (MPC) is a significant step towards making monetary policy more transparent and accountable. Discuss its composition, functions and importance. |

| 2017 | What is the Monetary Policy Committee (MPC)? Discuss its composition and critically evaluate its role in ensuring price stability while taking into account growth objectives. |

| 2018 | Examine the features of the inflation targeting framework adopted in India. What are the challenges faced by the RBI in the effective implementation of this framework? |

| 2019 | Do you think that the inflation targeting regime has reduced the flexibility of India’s monetary policy? Give arguments to support your view. |

| 2020 | Monetary policy tightening can help control inflation, but it also carries the risk of slowing down economic growth. Examine this trade-off in the Indian context. |

| 2021 | Why does food inflation remain structurally high in India? Discuss the key factors responsible and suggest reforms to address the issue. |

| 2022 | RBI’s ability to maintain price stability has come under pressure during periods of high inflation. Analyse the challenges it faces and suggest measures to strengthen its inflation management framework. |

| 2023 | How do global supply chain disruptions impact inflation management in India? Explain with suitable examples. |

| 2024 | India’s inflation targeting framework has contributed to macroeconomic stability, but it has also faced criticism on multiple fronts. Discuss. |