Why in the News:

Recently, the Supreme Court highlighted the growing menace of digital arrest frauds in India, in which victims, largely elderly citizens, have lost over ₹3,000 crore. The Court stressed that the problem is much larger than anticipated, with both financial and human consequences, and requires urgent intervention by authorities.

Background – Magnitude of the Issue

- A confidential report from the Union government revealed losses exceeding ₹3,000 crore in India due to digital arrest scams.

- The Supreme Court noted that the global impact could be significantly higher.

- Justice Surya Kant described the problem as a “very big challenge”, requiring immediate remedial action.

Nature and Modus Operandi of Digital Arrests

- Criminals impersonate judges, police officers, and government officials, leveraging fear to extort money.

- Use of Artificial Intelligence and advanced digital techniques allows them to morph faces, show fake courtrooms, and create a credible threat.

- Victims are coerced to pay substantial sums or promised employment abroad, which often results in human exploitation.

Vulnerable Victim Groups

- Primarily targets senior citizens, who are more susceptible to deception.

- Some victims are promised employment abroad but are subjected to exploitation akin to human slavery.

- Psychological trauma and financial losses are significant among the elderly.

Judicial and Government Response

- The Supreme Court emphasized issuing strict and supportive orders to empower investigative agencies.

- Suo motu cognizance was initially taken based on a case in Ambala, Haryana, where a senior couple was extorted ₹1.05 crore using forged court orders.

- Central Bureau of Investigation (CBI) may be tasked with probing these large-scale cybercrimes.Cross-Border and Organized Nature

- Attorney-General R. Venkataramani highlighted that these crimes originate across borders and are orchestrated by organized money-laundering gangs.

- Solicitor-General Tushar Mehta noted that these scams operate from “scam compounds” at a large scale, targeting multiple victims simultaneously.

Broader Implications

- The scams have dual consequences:

- Financial: Huge monetary losses for victims.

- Human: Anxiety, exploitation, and manipulation of vulnerable groups.

- Criminals use AI and digital morphing techniques to make threats appear authentic.

Conclusion:

The Supreme Court has highlighted the urgent need for stringent measures against digital arrest scams. Strengthening cybercrime regulations, cross-border cooperation, investigative mechanisms, and protective measures for the elderly are critical. Public awareness campaigns and technological solutions are also essential to prevent the escalation of this cybercrime menace.

Digital Arrest: The Modern Cyber Scam

In the early days of the internet, cybercriminal activity was mostly limited to defacing websites or harmless online pranks. However, today, cybercrime has evolved into a sophisticated and constantly changing industry, with fraudsters continuously adapting to new technologies and targeting millions of unsuspecting individuals.

The year 2024 saw a notable increase in cyber scams, with more than 92,000 people falling victim, particularly in cases involving digital arrest schemes. These scams have grown beyond simple online fraud, now operating on a scale reminiscent of the notorious “Jamtara” scams. The victims are increasingly diverse, ranging from high-ranking officials, journalists, and security personnel to elderly and vulnerable individuals. Cybercrime has thus transformed from a distant concern into a pervasive and everyday threat.

What is Digital Arrest?

- Digital arrest is a form of fraud aimed at extorting money from victims through fear, deception, and intimidation. In these scams, fraudsters impersonate law enforcement officers and threaten victims with arrest, freezing of bank accounts, or cancellation of passports to force them into paying a so-called “fine” or “security deposit” to avoid legal repercussions

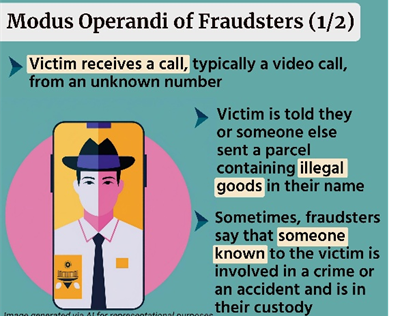

- The scam usually begins with a seemingly innocuous phone call, such as a notification about a parcel delivery or a request for KYC verification. Gradually, the scammer escalates the conversation, using increasingly aggressive tactics to induce panic, often alleging that the victim is involved in serious offenses such as money laundering, cybercrime, or drug trafficking.

- By presenting fake documents, doctored videos, and spoofed phone numbers, scammers create an impression of authenticity, pressuring victims to comply with their demands.

Why Do Digital Arrest Scams Happen?

Cybercriminals employ a wide range of tactics—from phishing emails and financial fraud to ransomware attacks—to steal sensitive data and money. These scams continue to thrive due to a combination of human vulnerabilities, technological loopholes, and evolving criminal methods. The main factors that make such scams effective include:

- Human Psychology & Social Engineering: A major reason for the success of cyber scams is human error. Scammers manipulate individuals into revealing confidential information using psychological tactics.

- Many people are unaware of common scam techniques, making them easy targets. Fraudsters exploit emotions such as fear (threats of legal action), excitement (fake lottery wins), or urgency (emergency fund requests).

- They often impersonate trusted sources like banks, government agencies, or even acquaintances to gain credibility.

- Weak Cybersecurity Practices: Poor digital hygiene makes individuals vulnerable. Weak passwords, outdated software, unpatched systems, and general negligence in cybersecurity allow cybercriminals easier access to personal and financial information.

- Rapidly Evolving Techniques: Cybercriminals continually adapt their methods to stay ahead of security measures, using increasingly sophisticated tools to evade detection.

- Risks from Digital Payments & Financial Transactions: The widespread adoption of digital payments has introduced new avenues for fraud, including fake UPI requests, QR code scams, SIM swaps, card skimming, and cryptocurrency or investment scams.

- Dark Web & Organized Cybercrime: The dark web acts as a marketplace for stolen data, malware, and other illicit tools. Cybercrime has become an organized industry where criminals buy and sell stolen identities, offer Ransomware-as-a-Service (RaaS), and operate syndicates for large-scale fraud.

- Weak Legal Framework & Enforcement: Many scams go unpunished due to slow law enforcement response, challenges in cross-border investigation, and inadequate public awareness or policy measures.

Typical Methods Used by Scammers/ Modus Operandi

- Initial Contact: Scammers pose as law enforcement or government officials (e.g., CBI, ED, Customs, Interpol) through phone calls, emails, WhatsApp messages, or fake official letters.

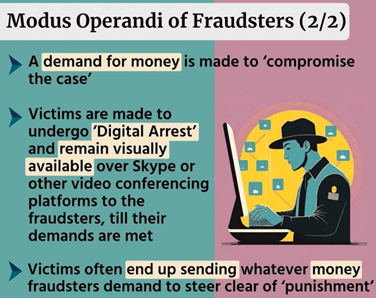

- Creating Panic: Victims are falsely accused of serious crimes like money laundering, cybercrime, or drug trafficking, and threatened with immediate arrest unless they comply.

- Digital Verification: Fraudsters send fake documents, doctored arrest warrants, and fabricated videos to lend legitimacy to their claims.

- Coercion: Victims are intimidated with threats such as account freezing, passport cancellation, or arrest. They are instructed not to consult family or lawyers and are coerced into paying a “security deposit” or fine.

- Payment Methods: Scammers demand payments via UPI, cryptocurrency, prepaid gift cards, or sometimes remotely monitor victims’ banking details.

- Disappearance: Once the money is transferred, the scammers vanish, leaving victims to realize the fraud only after verifying with authentic authorities.

- Money Laundering: Illicitly obtained funds are split into smaller amounts, funneled through multiple accounts, and ultimately transferred overseas for unlawful use.

Cybercrime Scenario in India

Rising Complaints: Cybercrime incidents are increasing rapidly:

- 1,35,242 complaints in 2021

- 5,14,741 complaints in 2022

- 11,31,221 complaints in 2023

Financial Impact: Total losses from cybercrime reached ₹27,914 crore (2021–September 2024).

Major Scam Types:

- Stock Trading Scams: ₹4,636 crore lost via 2,28,094 complaints; fraudulent promises of high returns from stocks, forex, or crypto.

- Ponzi/Pyramid Schemes: ₹3,216 crore lost through 1,00,360 complaints.

- Digital Arrest Frauds: ₹1,616 crore lost from 63,481 complaints.

- Fund Laundering: The I4C identified and froze around 4.5 lakh mule accounts used for laundering cybercrime proceeds.

Challenges in Addressing Cybercrime

- Anonymity & Privacy: Use of VPNs and encrypted messaging apps hides cybercriminals’ identities.

- Cross-Border Scope: Many scams originate from Southeast Asia and China, complicating jurisdictional actions.

- Evolving Tactics: Scammers use advanced phishing, social engineering, and AI-assisted calls.

- Malware Threats: Sophisticated malware bypasses antivirus protections to steal data.

- Regulatory Fragmentation: Different countries’ laws impede coordinated global action.

- Digital Expansion: Growth of e-commerce and digital payments has increased fake stores, card skimming, and fraudulent payment schemes.

Types of Cyber Scams in India

- Phishing Scams: Fake emails/messages mimicking trusted sources.

- Lottery & Prize Scams: Victims asked to pay fees to claim non-existent prizes.

- Emotional Manipulation/ Romance Scams: Money demanded under pretext of emergencies.

- Job Scams: Fake job listings trick job seekers into giving money or personal data.

- Investment Scams: Ponzi or pyramid schemes promising unrealistic returns.

- Cash-on-Delivery (CoD) Scams: Fake online stores delivering counterfeit or no products.

- Fake Charity Appeals: Fraudulent solicitations exploiting sympathy.

- Mistaken Money Transfer Scams: False claims of accidental deposits.

- Credit Card & Loan Scams: Upfront fees demanded for non-existent loans.

Key Government Initiatives

- National Cyber Security Policy

- CERT-In (Computer Emergency Response Team – India)

- Cyber Surakshit Bharat Initiative

- Cyber Swachhta Kendra

- National Critical Information Infrastructure Protection Centre (NCIIPC)

- Digital Personal Data Protection Act, 2023

- Citizen Financial Cyber Fraud Reporting & Management System

- National Cyber Crime Helpline (1930)

India’s Measures to Combat Cybercrime and Digital Arrest Scams

To tackle the rising threat of cybercrime and digital fraud, the Indian government has significantly enhanced its initiatives and infrastructure. Key measures include:

- Indian Cyber Crime Coordination Centre (I4C): Set up by the Ministry of Home Affairs, I4C serves as the central hub for coordinating national efforts to prevent and respond to cybercrime, offering resources and guidance for effective mitigation.

- National Cyber Crime Reporting Portal: This citizen-centric platform enables the public to lodge complaints related to cybercrime online, with particular attention to crimes targeting women and children. It facilitates prompt action by the relevant law enforcement agencies.

- Financial Cyber Fraud Reporting System: Launched in 2021, this system allows immediate reporting of financial frauds, helping recover funds and prevent further loss. To date, it has successfully saved over ₹3,431 crore across nearly 9.94 lakh complaints.

- Cyber Forensic Laboratories: Facilities like the National Cyber Forensic Laboratory in Delhi and the Evidence Lab in Hyderabad have enhanced the police’s ability to collect, manage, and analyze digital evidence effectively, strengthening investigative capabilities.

- Training via CyTrain: I4C’s online training platform educates law enforcement personnel and judicial officers on cyber forensic techniques, investigation procedures, and prosecution strategies. Over 98,000 police officers have received training so far.

- Public Awareness Campaigns: The government has launched wide-ranging awareness initiatives using SMS alerts, social media (Cyber Dost), SancharSathi portal and app, and digital displays in public spaces such as metro stations and airports, emphasizing cyber safety and responsible online behavior.

These efforts collectively reinforce India’s national framework against cybercrime, enhancing the country’s resilience and making the digital environment safer for citizens.

Indian Cyber Crime Coordination Centre (I4C)

Establishment: Launched in 2020 by the Ministry of Home Affairs.

Objectives:

- Serve as a nodal point to curb cybercrime nationally.

- Strengthen cybercrime prevention for women and children.

- Facilitate easy filing of cyber complaints and track crime trends.

- Act as an early warning system for law enforcement.

- Conduct public awareness campaigns.

- Train police, prosecutors, and judicial officers in cyber forensics, investigation, and cyber hygiene.

National Cyber Crime Reporting Portal

- A citizen-focused platform allowing individuals to report cybercrime online, with complaints accessed by the respective State/UT law enforcement agencies.

- Special emphasis on financial frauds, digital arrests, and crimes against women and children.

Way Forward / Recommendations

Digital Safety (PM’s 3-Step Protocol):

- Stop: Stay calm; avoid sharing personal information.

- Think: Verify legitimacy; agencies do not demand money over calls.

- Take Action: Report to National Cyber Crime Helpline (1930) or National Cyber Crime Reporting Portal, inform family, and preserve evidence.

Cybersecurity Best Practices:

- Use firewalls and encryption for sensitive data.

- Keep software and hardware updated.

- Implement two-factor authentication.

Banking Vigilance:

- Monitor high-value transactions in low-balance accounts.

- Alert authorities about suspicious transfers before conversion to cryptocurrency.

Public Awareness:

- Avoid sharing personal details like Aadhaar or PAN.

- Independently verify caller identities.

- Educate family and friends about common scam tactics.

International Cooperation:

- Countries must coordinate laws, share intelligence, and harmonize responses to tackle cross-border cybercrime effectively.

Conclusion

Digital arrests are one of the fastest-growing cyber threats in India, exploiting fear, deception, and digital technologies. While government initiatives like I4C, reporting portals, and public awareness campaigns have strengthened defenses, citizens’ vigilance, cyber hygiene, and proactive reporting remain critical. A combination of policy, technology, awareness, and international collaboration is essential to curb these scams and protect India’s digital ecosystem.

UPSC MAINS PYQs 1. What are the different elements of cyber security? Keeping in view the challenges in cyber security, examine the extent to which India has successfully developed a comprehensive National Cyber Security Strategy. (2022)