By reading this article you can solve the Model question-

How do geopolitical uncertainties and trade dynamics, such as the delay in the India-U.S. Trade Deal and record trade deficits, exacerbate the pressure on the Indian Rupee? In this context, elaborate on the importance of finalising strategic bilateral trade agreements as a countermeasure to stabilise the currency.

The Immediate Context: Asia’s Worst Performer

- Sharp Decline: The Rupee has depreciated significantly, making it the worst-performing currency in Asia year-to-date (CYTD), falling by over 5% in 2025.

- Psychological Mark Breached: The Rupee’s fall past the ₹88.8 level (previously defended by the RBI) and then the psychological mark of ₹90 has created market pressure and volatility.

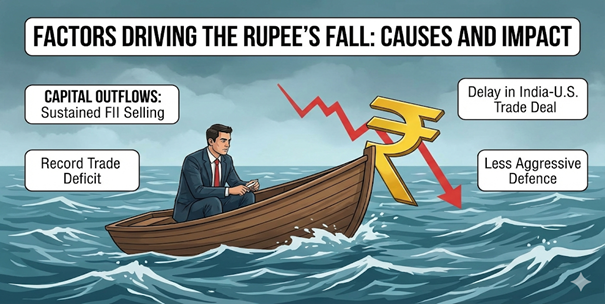

Key Factors Driving the Rupee’s Fall

The Rupee’s slide to a confluence of external shocks and domestic imbalances:

1. Sustained FII Selling

Foreign Institutional Investors (FIIs) are pulling capital out of Indian equity and debt markets. This creates a high, continuous demand for the US Dollar, thereby increasing its price against the INR. The pressure is clearly “emanating from a drying up of capital flows” rather than the current account.

2. Record Trade Deficit & US Tariffs

India’s trade deficit ballooned to a record high, driven by the 50% tariffs imposed by the US on Indian goods, severely impacting exports in labour-intensive sectors

3. Delay in India-U.S. Trade Deal

The lack of clarity or a delay in finalising a trade deal with the US is cited as a major factor impacting market sentiment. Analysts believe a swift deal could trigger a bounce-back.

4. Global Dollar Strength

Developed countries, particularly the US, have raised interest rates sharply. This widens the interest rate gap, making dollar-denominated assets more attractive, leading to capital shifting out of emerging markets like India

5. Less Aggressive Defence

Some experts note that the RBI under the current governor has been “less interventionist” than in the past, allowing the currency to find its level while only stepping in to curb extreme volatility.

Impact of a Weak Rupee

Positive Impacts

- Exports become cheaper/competitive — can stimulate export-oriented sectors.

- Import substitution incentive — domestic producers can gain.

- Some depreciation may improve current account balance over time.

Negative Impacts

- Imported inflation: Higher cost of crude, industrial inputs can push prices up. Capital flight vulnerability: Continued FPI outflows can weaken investor confidence.

- Corporate balance sheets: Unhedged foreign liabilities costlier; credit ratings may suffer.

- Inflation expectations: Pass-through may accelerate if oil/commodity prices rise.

- Fiscal impact: Subsidies and external debt servicing costs could rise.

Policy Recommendations

SHORT-TERM: Stabilise the Rupee Without Killing Growth

Targeted RBI Intervention (Already using ~$2–3 billion weekly smoothing)

- When the rupee hit ₹90.55/$, RBI reportedly sold dollars through banks to reduce intraday volatility.

- Example: In 2013 taper tantrum, RBI stabilised INR by selling reserves + opening special swap windows.

Strengthen Corporate Hedging (India’s unhedged FX exposure ≈ 40–45%)

- Encourage exporters/importers to hedge via cheaper long-tenure forwards.

- Example: After Turkey’s 2021 currency shock, unhedged companies faced insolvency—India must avoid this scenario.

Temporary Tariff/Custom Relief for Critical Imports

- Reduce excise/customs on essential imported inputs (e.g., fuel, edible oils).

- Evidence: A ₹1 fall in rupee raises India’s annual oil import bill by ₹10,000–12,000 crore.

MEDIUM-TERM: Reduce External Vulnerability

Fast-track India–US Trade Agreement (Stalled since 2020; high tariff losses)

- US tariffs affect > $10 billion of India’s exports (textiles, steel, pharma).

- A breakthrough could boost export earnings + reduce CAD pressure.

Ø Diversify Export Markets (Reduce dependence on US/EU where demand is slowing)

- Expand trade with Africa (8% of exports), Latin America (3%), where India is under-represented.

- Example: Vietnam boosted exports 20% by diversifying to Latin America & ASEAN.

Ø Boost Domestic Bond Market to Reduce FPI Dependence

- FPIs withdrew $18 billion in 2025 → weaken INR.

- Strengthen domestic bond participation (LICs, mutual funds) to replace volatile foreign capital.

LONG-TERM: Structural Reforms for a Strong, Independent Rupee

Ø Reduce Oil Import Dependence (India imports 85% of crude)

- Push green hydrogen, EVs, ethanol blending (already at 12%, target 20% by 2025).

- Example: Brazil’s ethanol policy cut its oil import dependence by 40% in a decade.

Ø Promote Rupee Internationalisation (Reduce USD dependence)

- Expand Local Currency Settlement Agreements (LCSAs) with Gulf & ASEAN nations.

- Example: India–UAE Rupee–Dirham settlement framework saved millions in transaction costs.

Ø Encourage High-Value Exports (Electronics, Pharma, Defence)

- Electronics import bill is >$55 billion/year — reducing this would stabilise the rupee long-term.

- Leverage PLI schemes to expand components manufacturing.

Conclusion:

The falling Rupee is a result of a global dollar strength cycle coinciding with domestic capital outflows and trade dynamics. While the government views it as manageable, analysts agree that the full economic impact depends on how quickly India can conclude trade agreements and whether global capital flows reverse course