After Reading This Article You Can Solve This UPSC Mains Model Question:

The Union Budget 2026–27 reflects a calibrated approach towards growth, inclusion, and fiscal consolidation.” Critically examine this statement in the context of India’s goal of achieving Viksit Bharat 2047. 250 words (GS-3, Economy).

CONTEXT

The Union Budget 2026–27, presented by Nirmala Sitharaman, is the first Budget prepared in Kartavya Bhawan, symbolising a shift from entitlement-based governance to duty-driven (“Kartavya”) development.

It is framed around three Kartavyas, aiming to balance growth, inclusion, and resilience amid global economic volatility, supply-chain realignments, and India’s aspiration of Viksit Bharat @2047.

Macroeconomic Snapshot

- Total Expenditure (BE 2026–27): ₹53.5 lakh crore

- Non-debt Receipts: ₹36.5 lakh crore

- Net Tax Receipts: ₹28.7 lakh crore

- Capital Expenditure: ~₹12.2 lakh crore (growth-oriented stance)

- Fiscal Deficit: 4.3% of GDP (glide path consolidation)

- Debt–GDP Ratio: 55.6% (improving sustainability)

Philosophy & Framework of the Budget

The Budget is anchored in three Kartavyas, reflecting a transition from entitlement-based to responsibility-based public policy.

1️. First Kartavya – Accelerate & Sustain Economic Growth

- Enhance productivity and competitiveness

- Build resilience against volatile global economic conditions

2. Second Kartavya – Fulfil Aspirations & Build Human Capacity

- Empower citizens as partners in India’s growth

- Focus on skills, employability, and services-led growth

3. Third Kartavya – Sabka Sath, Sabka Vikas

- Ensure equitable access to resources and opportunities

- Focus on regions, communities, and vulnerable sections

1. FIRST KARTAVYA: ACCELERATE & SUSTAIN ECONOMIC GROWTH

I. Manufacturing Push in Strategic & Frontier Sectors

(a) Biopharma SHAKTI (Strategy for Healthcare Advancement through Knowledge, Technology and Innovation)

- ₹10,000 crore (5 years) to position India as a global biopharma hub

- New & upgraded National Institutes of Pharmaceutical Education and Research (NIPER), 1,000+ clinical trial sites

Significance: Moves India up the pharma value chain

(b) India Semiconductor Mission (ISM) 2.0

- Focus on equipment, materials, full-stack IP, and industry-led R&D

- Reduces import dependence, strengthens strategic autonomy

(c) Electronics Components Manufacturing

- Outlay enhanced to ₹40,000 crore

- Complements PLI ecosystem

(d) Rare Earth Corridors

- Odisha, Kerala, Andhra Pradesh, Tamil Nadu

(e) Chemical Parks & Capital Goods

- 3 Chemical Parks (challenge mode)

- Hi-Tech Tool Rooms, CIE Scheme, Container Manufacturing (₹10,000 crore)

II. Integrated Programme for Textile Sector

- National Fibre Scheme:

Natural fibres (silk, wool, jute), man-made & new-age fibres - Textile Expansion & Employment Scheme:

Cluster modernisation, machinery, testing & certification - Mega Textile Parks:

Focus on technical textiles, value addition - Mahatma Gandhi Gram Swaraj Initiative:

Khadi, handloom & handicrafts + branding & global linkage

III. Rejuvenation of Legacy Industrial Clusters

- 200 clusters to be revived via infrastructure & technology upgrade

IV. Champion SMEs & Micro Enterprises

- ₹10,000 crore SME Growth Fund to create future Champions, incentivizing enterprises based onselect criteria

- Additional ₹2,000 crore to Self-Reliant India Fund to continue support to micro enterprises and maintain their access to risk capital.

- Corporate Mitras via ICAI/ICSI/ICMAI to design short-term, modular courses and practical tools.

V. Infrastructure as Growth Engine

- Public Capex: ₹12.2 lakh crore

- Infrastructure Risk Guarantee Fund (crowding-in private investment)

- New Dedicated Freight Corridor (Dankuni–Surat)

- 20 National Waterways (5 years)

- Start: NW-5 (Odisha – Talcher/Angul to Paradeep/Dhamra)

- Ship repair hubs: Varanasi & Patna

- Coastal Cargo Promotion Scheme- Modal share: 6% → 12% by 2047

- Seaplane VGF Scheme (connectivity + tourism)

VI. Energy Security & Climate Action

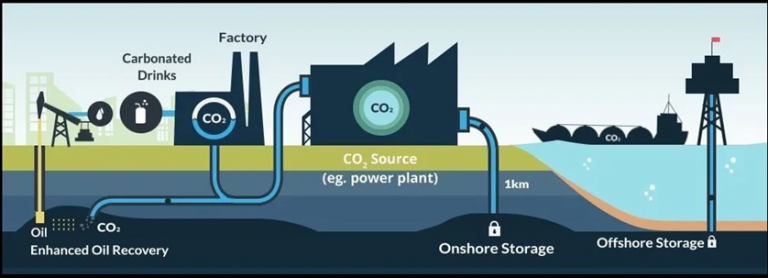

- ₹20,000 crore for Carbon Capture Utilisation & Storage (CCUS)

VII. City Economic Regions (CERs)

- ₹5,000 crore per CER (5 years)

- 7 High-Speed Rail Corridors as growth connectors

- Municipal Bonds: ₹100 crore incentive for issuances >₹1000 crore

2. SECOND KARTAVYA: ASPIRATIONS & HUMAN CAPITAL

I. Services-Led Growth

- High-Powered Education-to-Employment & Enterprise Committee recommends measures that focus on the ServicesSector as a core driver of Viksit Bharat.

II. Health & Human Resources

- 100,000 Allied Health Professionals to be added over the next 5 years.

- 5 Regional Medical Hubs (medical tourism)

- 3 new All India Institutes of Ayurveda

- 1 girls’ hostel to be established in every district

III. Orange Economy (AVGC)

- Visual Effects, Gaming and Comics (AVGC) labs in 15,000 schools & 500 colleges, Support via Indian Institute of Creative Technologies, Mumbai

IV. Tourism, Culture & Sports

- National Institute of Hospitality

- 10,000 trained tourist guides in 20 tourist sites

- National Destination Digital Knowledge Grid to digitally document all places of significance—cultural, spiritual andheritage.

- 15 iconic heritage sites (Lothal, Dholavira, Rakhigarhi, Adichanallur, Sarnath, Hastinapur, and Leh Palace etc.) to be developed into vibrant, experiential cultural destinations

- Khelo India Mission (decade-long vision)

3. THIRD KARTAVYA: SABKA SATH, SABKA VIKAS

I. Increasing Farmer Incomes (Centred on water security, crop diversification, and digital enablement).

- Integrated development of 500 reservoirs & Amrit Sarovars to reinforce irrigation capacity, ensure reliable water availability, and strengthen rural livelihoods.

- High-value crops: coconut, sandalwood, cocoa, cashew

- Coconut Promotion Scheme

- Bharat-VISTAAR: (Virtually Integrated System to Access Agricultural Resources)— a multilingual, AI-enabled platform that integrates AgriStack portals with ICAR’s agricultural practice packages,

II. Empowering Divyangjan

- Divyangjan Kaushal Yojana (IT, AVGC, hospitality)

III. Mental Health & Trauma Care

- NIMHANS-2 in North India

- Upgrade Ranchi & Tezpur institutes as regional apex bodies.

IV. Purvodaya & North-East Focus

- East Coast Industrial Corridor (node at Durgapur)

- 5 tourism destinations in Purvodaya States

- 4,000 e-buses

- Development of Buddhist Circuits in Arunachal Pradesh, Sikkim, Assam, Manipur, Mizoram and Tripura.

Fiscal Federalism: Government provided ₹1.4 lakh crore to the States for the FY 2026-27 as Finance Commission Grants as recommended by the 16th Finance Commission.

Critical Analysis of Union Budget 2026–27

Strengths of Union Budget 2026–27

- Strong growth push with fiscal prudence: Public capital expenditure raised to ₹12.2 lakh crore, while fiscal deficit reduced to 4.3% of GDP (from 4.4% in 2025–26).

- Manufacturing and self-reliance focus: Major allocations such as ₹40,000 crore for electronics components, ₹10,000 crore for Biopharma SHAKTI, and ₹10,000+ crore for container manufacturing strengthen industrial depth.

- Infrastructure-led multiplier effect: Total expenditure at ₹53.5 lakh crore, with large investments in freight corridors, waterways (20 NWs), and high-speed rail to boost logistics efficiency.

- Support to MSMEs and entrepreneurship: ₹10,000 crore SME Growth Fund and ₹2,000 crore additional support to the Self-Reliant India Fund improve access to risk capital.

- Energy and sustainability orientation: ₹20,000 crore committed over five years for Carbon Capture, Utilisation and Storage (CCUS), aligning growth with climate goals.

- Human capital and services emphasis: Creation of 100,000 Allied Health Professionals, AVGC labs in 15,000 schools and 500 colleges, and tourism skill initiatives strengthen employment potential.

- Balanced regional and social inclusion: Targeted spending on Purvodaya & North-East, agriculture (500 reservoirs, Amrit Sarovars), and ₹1.4 lakh crore Finance Commission grants to States.

Concerns of Union Budget 2026–27

- High borrowing requirement: Gross market borrowing at ₹17.2 lakh crore keeps pressure on interest rates and private investment (crowding-out risk).

- Revenue dependence on optimistic assumptions: Net tax receipts projected at ₹28.7 lakh crore may be vulnerable to global slowdown and trade uncertainties.

- Implementation capacity risks: Large-scale initiatives—200 legacy clusters, 20 national waterways, 7 high-speed rail corridors—demand strong Centre–State coordination.

- Limited direct income support to farmers: Despite structural measures (500 reservoirs, high-value crops), absence of major enhancement in direct income transfers may delay short-term relief.

- Private investment uncertainty: Infrastructure Risk Guarantee Fund announced, but effectiveness depends on design; private capex response remains unclear.

- Social sector outlay visibility: While programmes are announced (mental health, Divyangjan, skills), explicit budgetary allocations for some schemes are not clearly specified.

WAY FORWARD

- Strengthen implementation: Ensure time-bound execution through robust Centre–State coordination, outcome-based monitoring, and third-party audits.

- Deepen fiscal consolidation: Gradually reduce debt–GDP ratio by broadening the tax base, improving compliance, and rationalising non-merit subsidies.

- Crowd-in private investment: Operationalise the Infrastructure Risk Guarantee Fund with clear rules to unlock private and foreign capital.

- Boost farm incomes faster: Complement structural reforms with targeted income and price-risk support, stronger agri-value chains, and export facilitation.

- Enhance human capital delivery: Align skilling, education, and health initiatives with industry demand through PPPs and district-level skill mapping.

- Improve transparency: Clearly earmark and disclose scheme-wise allocations and outcomes to strengthen credibility and accountability.

CONCLUSION

The Union Budget 2026–27 lays the foundation for Viksit Bharat 2047 by combining fiscal discipline, manufacturing-led growth, and human capital investment. Its focus on infrastructure, technology-driven agriculture, green transition, and inclusive regional development positions India to transform demographic potential into sustainable, globally competitive prosperity.