After Reading This Article You Can Solve This UPSC PYQ:

How have the recommendations of the 14th Finance Commission of India enabled the States to improve their fiscal position? 150 Words (GS-2, Polity)

Context

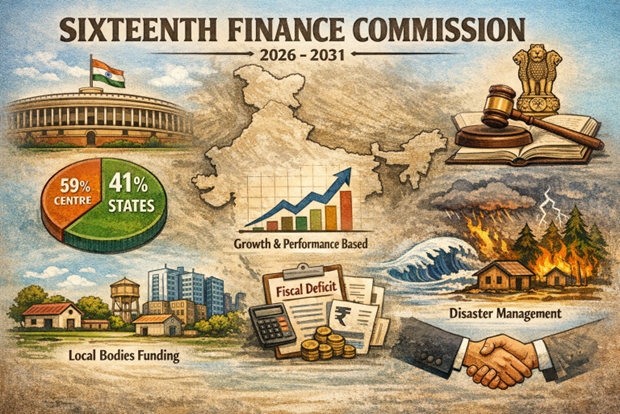

The 16th Finance Commission (FC) has submitted its report to the President on November 17, 2025, marking a pivotal moment in India’s fiscal federalism for the award period of 2026–31.

About the Finance Commission (FC)

The FC is a Constitutional Body acting as the “balancing wheel” of fiscal federalism in India.

- Article 280: Mandates the President to constitute an FC every five years.

- Composition:Chairman: Dr. Arvind Panagariya.

- Full-time Members: Shri Ajay Narayan Jha, Smt. Annie George Mathew, and Dr. Manoj Panda.

- Part-time Member: Dr. Soumya Kanti Ghosh.

- Key Functions:

- Vertical Devolution: Distribution of net proceeds of taxes between the Union and States.

- Horizontal Devolution: Allocation of these proceeds among the States.

- Grants-in-aid: Principles governing grants to States from the Consolidated Fund of India (Article 275).

- Local Bodies: Measures to augment the State Consolidated Fund for Panchayats and Municipalities.

Key Recommendations of the 16th FC (2026–31)

1. Vertical Devolution (Union to States)

- Despite strong demands from several states (especially from the South) to increase the share to 45–50%, the 16th FC has maintained the status quo.

- Share Retained at 41%: The states’ share in the “net proceeds” (divisible pool) of Union taxes remains at 41%.

- The “Cess” Concern: The Commission flagged the shrinking divisible pool due to the Centre’s increased reliance on cesses and surcharges (which are not shared), though it did not recommend their inclusion in the pool.

2. Horizontal Devolution (Inter-state Allocation)

- The formula to divide the 41% among the 28 states has been redesigned to reward economic output and ecological preservation.

| Criterion | Weight (%) | Significance |

| Income Distance | 42.5% | Ensures equity for lower-income states. |

| Population (2011) | 17.5% | Reflects the scale of service delivery requirements. |

| Demographic Performance | 10.0% | Redefined to measure population growth between 1971–2011. |

| Area | 10.0% | Accounts for higher costs in geographically large/sparse states. |

| Forest & Ecology | 10.0% | Now includes “Open Forests” to reward ecological maintenance. |

| Contribution to GDP | 10.0% | New Criterion. Replaces “Tax Effort.” Rewards states contributing more to national economic output. |

Note: The “Tax and Fiscal Effort” criterion used by the 15th FC has been subsumed/replaced by the Contribution to GDP metric.

3. Grants-in-Aid (₹9.47 Lakh Crore Total)

- A major shift in the 16th FC is the discontinuation of Revenue Deficit Grants, Sector-specific grants, and State-specific grants. Funding is now concentrated on two pillars:

A. Local Body Grants (₹7.91 Lakh Crore)

- Rural-Urban Split: Allocated in a 60:40 ratio between Rural (RLBs) and Urban Local Bodies (ULBs).

- Performance Linkage: 80% as Basic Grants and 20% as Performance-based.

- Conditions: Grants are only released if states:

- Timely constitute State Finance Commissions (SFCs).

- Publicly disclose audited accounts of local bodies.

- Urbanization Premium: A one-time grant of ₹10,000 crore to states that successfully merge peri-urban villages into larger cities.

B. Disaster Management (₹2.04 Lakh Crore)

- SDRF & SDMF: Funds split between Response (SDRF) and Mitigation (SDMF) to prioritize prevention.

- Cost Sharing: Maintained at 75:25 for general states and 90:10 for North-Eastern and Himalayan states.

4. Fiscal Roadmap and Reforms

- The Commission has set strict targets to ensure long-term debt sustainability.

- Fiscal Deficit Targets:

- Centre: Reduce to 3.5% of GDP by 2030–31.

- States: Cap at 3% of GSDP.

- Off-Budget Borrowing: Recommended a total ban on off-budget borrowings; all liabilities must be transparently included in the budget.

- Power Sector: States are “cautiously nudged” to privatize DISCOMs to reduce the massive debt burden on state exchequers.

- Subsidy Rationalization: Advised states to review “unconditional cash transfers” and implement strict exclusion criteria for welfare schemes.

5. Public Sector Enterprise (PSE) Reforms

- Exit Strategy: Recommended the closure of 308 inactive State PSEs.

- Performance Review: State PSEs incurring losses for 3 out of 4 consecutive years must be reviewed by the State Cabinet for privatization or closure.

Significance of the 16th Finance Commission

- Reward for Productivity: Introduces “Contribution to GDP” (10% weight) to shift focus from mere equity to rewarding economic efficiency and national growth.

- Fiscal Hard-Budget Constraint: Mandates a ban on off-budget borrowings and scraps Revenue Deficit Grants, forcing states to achieve genuine self-sustainability.

- Third-Tier Autonomy: Links 20% of grants to performance and GIS-based tax reforms, transforming local bodies from “grant-seekers” into revenue-generating entities.

- Balanced Federalism: Protects performing states by weighing Demographic Performance and Open Forest cover, ensuring population control and ecology don’t lead to financial loss.

- Macro-Stability for 2047: Sets a strict debt-reduction path (3.5% Central deficit) to provide the fiscal stability required for India’s transition to a high-income economy.

Concerns Regarding the 16th Finance Commission

1. The “Cess and Surcharge” Loophole

- Shrinking Pool: Cesses and surcharges are not shared with states. Their share in the Centre’s Gross Tax Revenue has risen from ~5% in 2013 to ~11-12% in 2025-26.

- Effective Devolution: While the nominal devolution is 41%, the effective transfer to states is often closer to 31-32% once cesses are excluded.

2. Discontinuation of Revenue Deficit Grants (RDGs)

- The 16th FC has completely scrapped RDGs, which were traditionally used to “plug the gap” for states that could not meet revenue expenditures.

- Crisis for Hilly States: Special category states like Himachal Pradesh and Uttarakhand argue that their topographical constraints make revenue deficits structural and unavoidable.

- Asymmetric Federalism: Critics argue that removing this “safety net” ignores the diverse fiscal realities of states that lack industrial bases.

3. “Efficiency” vs. “Equity” (The South-North Divide)

- The introduction of “Contribution to GDP” (10%) and the reduction of “Income Distance” (to 42.5%) has created friction:

- Performance Penalty: High-performing southern states (Tamil Nadu, Kerala) feel that the 2011 Census-based population criteria still penalize them for successful family planning.

- Poorer States’ Loss: States like Bihar and Uttar Pradesh have seen a marginal decline in their share because the weight for “Income Distance”—their primary source of funds—was reduced to accommodate the new GDP parameter.

4. Erosion of State Fiscal Autonomy

- The 16th FC’s roadmap is seen by some as an “over-centralization” of fiscal policy:

- Tied Grants: A significant portion of local body grants (20% performance-based and 50% of basic grants) is “tied” to specific sectors like sanitation and water.

- Conditionalities: Linking grants to the privatization of DISCOMs or the closure of loss-making State PSEs is viewed as an intrusion into the policy domain of state legislatures.

5. Transition to “Compliance-Driven” Federalism

- The shift from “entitlement” to “compliance” raises concerns about social welfare:

- Squeeze on Welfare: The strict 3% GSDP deficit cap and the ban on off-budget borrowings may force states to slash spending on health, education, and social security.

- Contractionary Risk: In times of economic slowdown, states may lack the fiscal space to provide counter-cyclical stimulus due to these rigid caps.

Measures To strengthen Fiscal Federalism

1. Reforming the Divisible Pool

- Capping Cesses and Surcharges: There is a need for a constitutional amendment or a legal ceiling (e.g., at 10% of Gross Tax Revenue) on cesses and surcharges. Currently, these are not shared with states, effectively reducing their 41% share to ~31%.

- Inclusion in Divisible Pool: Gradually include long-standing cesses (like the Health and Education Cess) into the divisible pool to restore the vertical balance.

2. Enhancing State Revenue Autonomy

- GST Flexibility: Allow states a narrow “tax band” within the GST framework to vary rates on specific demerit goods to meet local fiscal shocks.

- Personal Income Tax Sharing: A proposal to allow states to “top up” or receive a 50:50 share of the personal income tax base from their territory would reward high-performing states and reduce their dependence on central grants.

3. Strengthening Local Governance (The Third Tier)

- Empowering SFCs: State Finance Commissions (SFCs) must be constituted every five years without delay. The 16th FC’s measure to link central grants to the timely submission of SFC reports is a critical step.

- Direct Fund Flow: Use the Public Financial Management System (PFMS) to transfer local body grants directly to Panchayats/Municipalities, bypassing state treasury delays.

4. Rationalizing Expenditure

- Centrally Sponsored Schemes (CSS) Reform: Move toward “Block Grants” for CSS, giving states the flexibility to design scheme components based on local geography (e.g., different needs for Bihar vs. Kerala).

- Sunset Clauses on Subsidies: Implement the 16th FC’s recommendation of fixed end-dates for non-merit subsidies to prevent permanent “fiscal leakages.”

5. Institutional Re-engineering

- Reactivating the Inter-State Council (ISC): Under Article 263, the ISC should meet quarterly specifically for fiscal dispute resolution, acting as a “political GST Council” for non-tax issues.

Conclusion

The 16th Finance Commission transitions India from “entitlement-based” transfers to “performance-linked” federalism. By prioritizing GDP contribution and fiscal transparency, it establishes a blueprint for a Viksit Bharat, balancing regional equity with the competitive efficiency required for a $10 trillion economy.