After Reading This Article You Can Solve This UPSC Mains Model Question:

Discuss how recent government initiatives in the solar sector reflect India’s strategy to strengthen energy security, boost domestic manufacturing, and advance climate commitments.15 marks (GS-2, International Relations)

Context

The United States announced its withdrawal from 66 international organisations, citing that these institutions no longer served American national interests. Among them were key climate-related platforms, including the International Solar Alliance (ISA)—a multilateral initiative headquartered in India and jointly led by India and France.

What is the International Solar Alliance (ISA)?

Origin and Objective

- Established: 2015 (India–France initiative, launched on the sidelines of COP21)

- Core Objective: To make solar energy affordable, accessible, and scalable, particularly in tropical and developing countries

Functional Role

- ISA does not build solar plants directly

- Acts as a facilitator and enabler by:

- Mobilising concessional and blended finance

- Reducing investment risks

- Supporting capacity-building, training, and policy frameworks

Membership and Reach

- Over 120 member countries

- Active across Africa, Asia, and Small Island Developing States (SIDS)

U.S. Engagement

- Joined ISA relatively late in 2021

- Contributed approximately $2.1 million over three years

- Contribution constituted only about 1% of ISA’s total funds

Impact of U.S. Withdrawal on the International Solar Alliance (ISA)

1. Financial Impact

- Budget Contribution: The U.S. contributed only ~1% of the ISA’s total funds ($2.1 million over three years).

- Core Funding: The ISA remains primarily funded by India, France, and voluntary contributions from other member states.

- Status: No ongoing projects inside India or major ISA operations will be shut down due to a lack of U.S. funds.

2. Strategic & Diplomatic Impact

- Leadership Vacuum: The exit of a major global power reduces the “multilateral weight” of the alliance.

- Confidence Gap: While India leads, U.S. participation provided a “stamp of global approval” that attracted private investors. Its absence may make international lenders more cautious.

- Geopolitical Space: The exit cedes diplomatic ground to other powers, potentially allowing China to increase its influence in the renewable sector through its own bilateral initiatives.

3. Operational Impact

- Inside India: Zero impact. India is self-reliant in solar manufacturing (~144 GW module capacity) and project financing via domestic banks.

- Outside India (The Global South): High risk. The ISA’s primary mission is to help LDCs (Least Developed Countries) and SIDS (Small Island Developing States) in Africa and the Pacific. Without U.S. technical expertise and diplomatic backing, these regions may find it harder to secure “cheap loans.

Sectoral Implications: Economics & Market Dynamics

1. Funding Resilience & Price Stability

- Fiscal Insulation: Solar project costs in India are primarily driven by domestic demand and imports from China, not U.S. funding. Since U.S. contributions accounted for only ~1% of the ISA’s budget, the financial impact of their exit is negligible.

- Capital Security: Projects remain backed by domestic banks, state utilities through long-term PPAs, and global green funds that operate independently of U.S. government policy.

2. Manufacturing: The “144 GW Shield”

- Capacity Surge: In 2026, India’s 144 GW module capacity acts as a strategic buffer. This far-sighted push for local manufacturing now insulates India’s energy security from the volatile domestic politics of Western nations.

- Import Dependency: Despite manufacturing gains, India remains heavily dependent on China for upstream components (wafers/cells), importing ~$1.7B in FY25. The U.S. exit does not change this reality but reinforces the need for backward integration.

3. Export Vistas & the “Y2K Moment”

- Filling the Gap: As the U.S. slows its renewable approvals and faces tensions with China/Mexico, Indian manufacturers have a unique window to become the primary high-quality alternative supplier to the American market.

- Job Security: Solar jobs remain secure, tied to local installation and maintenance required to meet India’s goal of 500 GW non-fossil capacity by 2030.

Significance of International Solar Alliance for India

- The Responsibility Shift: As the U.S. exits the ISA and UNFCCC, India is no longer just a participant—it is the sole guarantor of the interests of the Global South.

- Diplomatic Capital: India’s leadership in the ISA becomes a high-stakes test of its “Strategic Autonomy.” By successfully running the ISA without a superpower, India proves it can manage global institutions on its own terms.

- Filling the Vacuum: The U.S. retreat is widely seen as a “gift to China,” which is eager to use its Belt and Road Initiative (BRI) to dominate renewable energy in Africa and Asia.

- India’s Advantage: India offers a “Partnership-led” model (via ISA) versus China’s “Debt-led” model. The significance lies in whether India can mobilize the $1,000 billion needed for the “Towards 1000” strategy to keep Global South nations within its orbit.

- Supply Chain Validation: In 2026, India’s 144 GW module capacity acts as a shield. The U.S. exit proves that India’s push for local manufacturing was a far-sighted move to insulate its energy security from the volatile domestic politics of Western nations.

- New Export Vistas: With U.S. tariffs hitting China and Mexico, India’s solar industry faces a “Y2K moment”—an opportunity to become the primary high-quality alternative supplier to the American market.

- Narrative Control: India now has more space to push for CBDR-RC (Common But Differentiated Responsibilities). With the U.S. out, India can recalibrate the global climate narrative to focus on “Energy Poverty” rather than just “Emission Cuts.”

- Bilateral Pivot: The significance lies in a shift from multilateral dependence to bilateral strength. India is fast-tracking deals with the EU and UAE (Green Corridors) to replace lost U.S. technical channels

Key Government Initiatives

- PM Surya Ghar- Muft Bijli Yojana: Targets 1 crore households with rooftop solar by March 2027, providing up to 300 free units/month. Offers graded subsidies and aims to cut power subsidies while generating large-scale employment.

- PLI Scheme for High-Efficiency Solar PV Modules: With an outlay of ₹24,000 crore, it promotes integrated “wafer-to-module” manufacturing. The scheme seeks 65–70 GW annual domestic capacity, reducing import dependence.

- PM-KUSUM: Extended till March 2026 to de-dieselise agriculture through decentralised solar solutions. It supports solar plants on barren land, standalone solar pumps, and solarisation of grid-connected pumps.

- Green Energy Open Access (GEOA) Rules, 2025: Lower the open-access threshold to 100 kW, enabling C&I consumers to directly procure green power. Deemed approvals within 15 days improve ease of doing renewable business.

- Solar Park Scheme: Targets 40 GW capacity by March 2026 through a plug-and-play model. Provides land and transmission infrastructure to accelerate large-scale solar deployment.

Way Forward

- Diversify Partners: Deepen ties with the EU, Japan, and UAE to replace U.S. technical and financial presence. The India-EU Strategic Agenda 2030 (signed Jan 2026) is a vital tool here.

- Lead the “Global South”: Use the ISA to provide Climate Justice for Africa and Pacific Island nations. India must prove that a “South-led” institution can function effectively without a Western superpower.

- Blended Finance: Launch new credit-guarantee mechanisms to attract private capital to “risky” markets in Africa.

- “Solar Bonds”: Issuing ISA-certified Green Bonds in Indian and European markets to mobilize the $1,000 billion target for the “Towards 1000” strategy.

- Upstream Focus: Use PLI 3.0 to move beyond module assembly into high-tech Solar Cell and Wafer manufacturing to break the $1.7B Chinese import dependency.

- Standards Leadership: Establish Indian technical standards as the global benchmark for ISA members, creating a captive market for Indian solar exports.

- R&D Synergy: Focus on integrating solar with Battery Storage (BESS) and Green Hydrogen to address the intermittency of solar power.

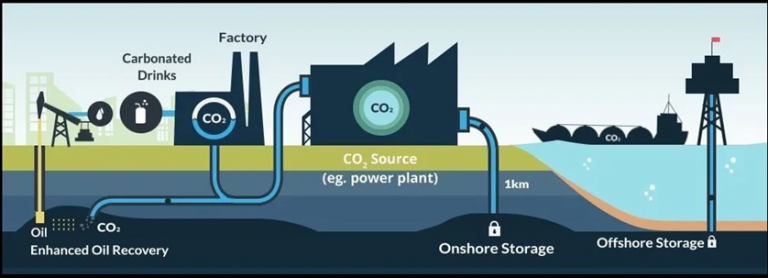

- DAC Integration: As per recent trends, promote Direct Air Capture (DAC) technologies in ISA member countries as a supplementary sequestration tool.

Conclusion

The U.S. withdrawal from the International Solar Alliance does not undermine India’s solar growth, investment pipeline, or employment base. Instead, it highlights a fragmenting global climate governance landscape, where large powers are increasingly inward-looking.